A third rail in politics is so named because the real third rail in an electric rail system is the one that carries the high voltage. Social Security and Medicare have long been considered the epitomes of such untouchable third rails in American politics, given that reform often results in fear-mongering directed at the elderly who happen to be the most likely people to vote.

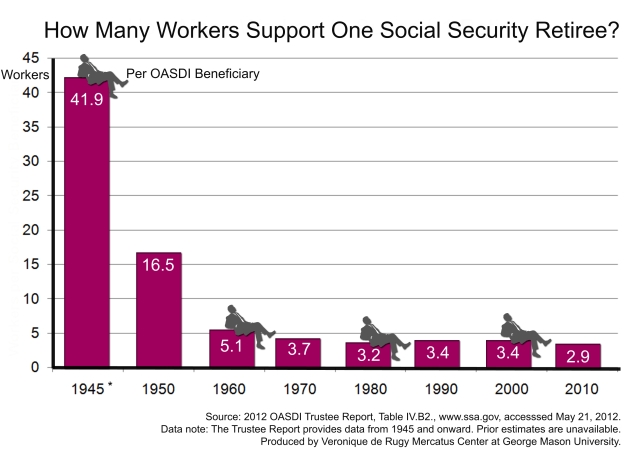

Given that Social Security is set up on an original construct for which existing workers pay into the program for existing retirees, the inevitable demographic plunge beyond the baby boomers was always going to create the conditions for unsustainability for a system that many assume works more like a funded account over time rather than the hard to sustain and largely middle class and age-based wealth transfer scheme that it actually is. As the graph below indicates, there has been a precipitous decline in the number of workers per existing Social Security beneficiary. Alas, there are two immutable forces that will colossally collide unless leadership and reason is discovered on this issue: one force that indicates that Social Security will be out of money by the 2030s, and the other force that indicates that current beneficiaries will not politically allow downgrades to their benefits. This prompted one tax professor that I had while in graduate school to provide the personal advice to the class to err on the side of caution and assume that our deductions for Social Security as simply an income tax that we would never see again.

Enter a reform proposal from the American Enterprise Institute that addresses both immutable forces by largely shifting to a system based upon what they call a flat benefit. While there have been many calls for means-testing benefits (i.e. people above a certain income threshold get no or much less benefits) this proposal calls for a reduction in the complexity of the tiers and calculations for benefits with a flat rate for all above a certain level of income, some subsidization for the poor into retirement, changing of the retirement age proposals to make 401K contributions more favorable form a tax and regulatory standpoint, eliminating the payroll tax after the age of 62 to incentivize work into older age, and a few other rather wonkish details to make Social Security more solvent and more market based while throwing in enough sweeteners to the current beneficiary to make it politically palatable.

While I would much prefer that we as individuals be freed up to make the investment and saving decisions that fit our own goals and be freed entirely of the nannying arm of the state while eliminating the giant middle-class and age-based wealth transfer scheme that Social Security largely is, this proposal has a lot going for it as it relates to creating a more clear and level-playing field while also pushing more retirement saving and planning at the margins to the private investment market, particularly for those that make more than the flat-benefit provision – in essence means-testing by another form and removing the upper middle class and wealthy largely out of the middle class wealth transferring. If throwing a few sops to the elderly is what is required to actually enact reform, then so be it. This is a good reform proposal that is a step in the right direction.